johnson county kansas vehicle sales tax calculator

The core responsibilities are tax calculation billing and distribution. Ad Lookup Sales Tax Rates For Free.

Johnson County Worries Sales Tax Commercial Property Tax The Kansas City Star

Maximum Local Sales Tax.

. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 928 in Johnson County Kansas. Kansas has a 65 statewide sales tax rate but also. The rate ranges from 75 and 106.

This rate includes any state county city and local sales taxes. Treasury Taxation and Vehicles. The Kansas state sales tax rate is currently.

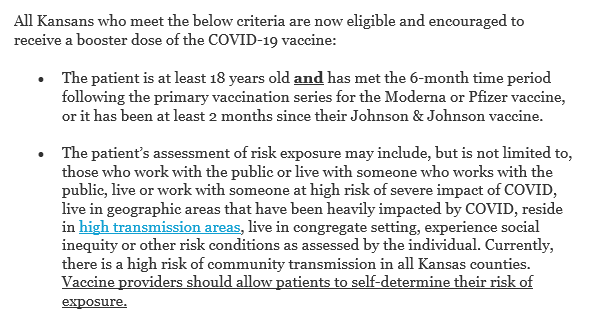

The minimum combined 2022 sales tax rate for Johnson County Kansas is. Johnson County Sales Tax Rates for 2022. For instance if you purchase a vehicle from a private party for 27000 and you live in a county.

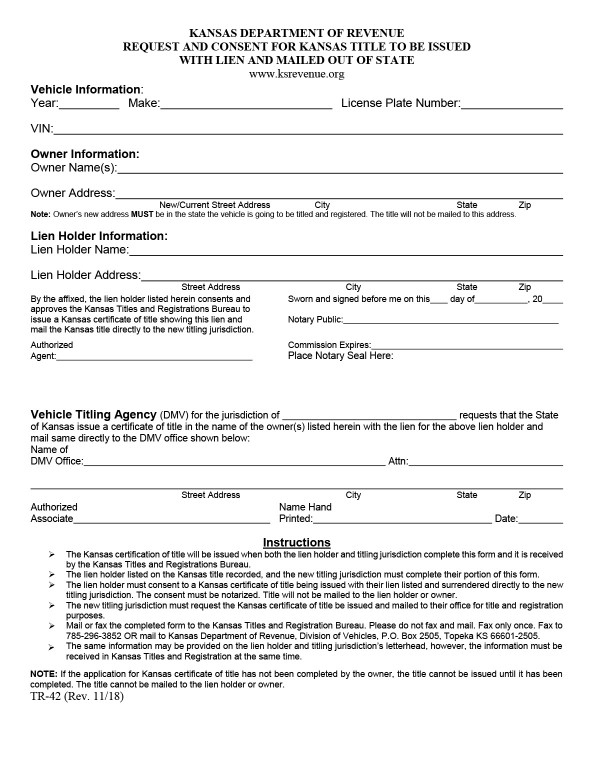

Treasury Taxation and Vehicles merges the functions of the County Clerk Register of Deeds and Treasurer into one department. The median property tax on a 20990000 house is 270771 in. Average Local State Sales Tax.

2020 rates included for use while preparing your income tax deduction. Average local state sales tax. Kansas Vehicle Property Tax Check - Estimates Only.

The Johnson County Kansas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Johnson County Kansas in the USA using average Sales Tax Rates. Kansas Vehicle Property Tax Check - Estimates Only. In addition to taxes car.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year.

The latest sales tax rate for Johnson County KS. Maximum Possible Sales Tax. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Vehicle property tax is due annually. Ad Lookup Sales Tax Rates For Free. Interactive Tax Map Unlimited Use.

The Johnson County Kansas sales tax is 798 consisting of 650 Kansas state sales tax and 148 Johnson County local sales taxesThe local sales tax consists of a 148 county sales. Calculating Sales Tax Summary. Johnson County in Kansas has a tax rate of 798 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Johnson.

Interactive Tax Map Unlimited Use. The kansas sales tax rate is currently. The calculator will show you the total sales tax amount as well.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. The minimum combined 2022 sales tax rate for Johnson County Kansas is. The Johnson County Property Tax Division serves as both the County Clerk and Treasurer.

This is the total of state and county sales tax rates. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year.

Kansas State Sales Tax. For comparison the median home value in Johnson County is. Kansas has a 65 sales tax and Johnson County collects an additional.

The state sales tax applies for private car sales in Kansas. Sales Tax Table For Johnson County Kansas. There are also local taxes up to 1 which will vary depending on region.

Car Tax By State Usa Manual Car Sales Tax Calculator

Indiana Property Tax Calculator Smartasset

Johnson County Kansas Wikipedia

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Johnson County Kansas Legends Of Kansas

Johnson County Kansas Legends Of Kansas

Kansas Bill Of Sale How To Transfer Ownership Of Personal Property

Greenlight Hot Pursuit 2008 Ford Crown Victoria Johnson County Ks Sheriff K9 Ebay

Maintaining Merriam City Of Merriam

Kansas Car Registration Everything You Need To Know

Johnson County Ks Businesses For Sale Bizbuysell

Tax Breakdown Shawnee Kansas Economic Development Council

Johnson County Kansas Homeowners May See 11 Property Value Increase

Johnson County Was Ranked 2 For Counties With The Best Quality Of Life R Kansascity

Johnson County Property Values Continue Sharp Rise New Homes Going For 550 000 On Average

Sales Tax Bonner Springs Ks Official Website